Management Policy / Management Strategy

New Medium-Term Management Plan

The Starzen Group formulated the new medium-term management plan using a backcasting approach, whereby measures and numerical targets were calculated based on factors such as the market size projected 10 years from now and the future vision for the company.

New Medium-Term Management Plan (fiscal 2023-2025)

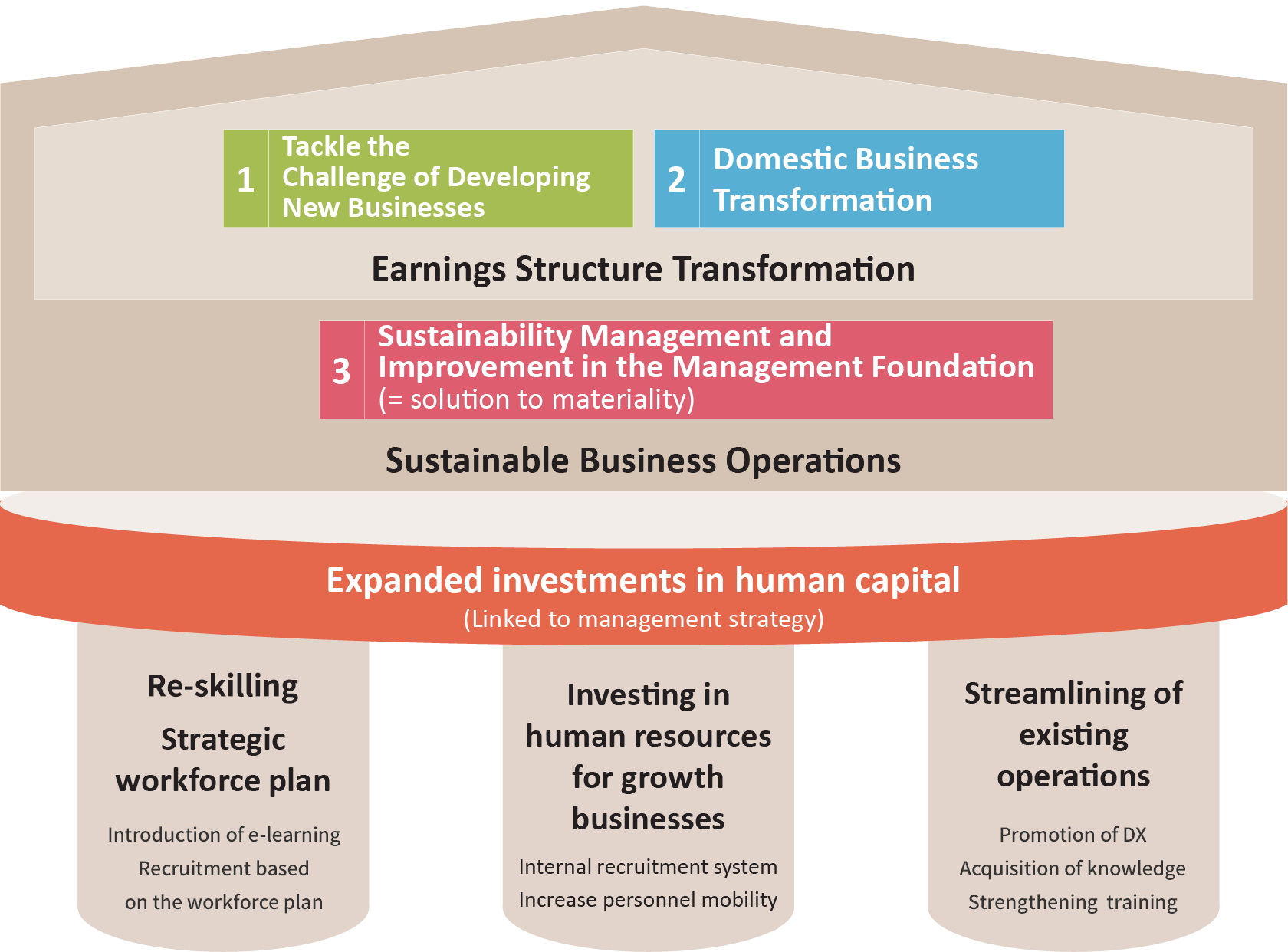

Themes of the New Medium-Term Management Plan “Transform the earnings structure and engage in sustainable business operations”

This three-year period from fiscal 2023 is positioned as a time to lay the groundwork for continuously contributing to society through our long term development.

We will establish a new earnings base by restructuring our domestic business into a more resilient supply chain as well as expanding sales in overseas business and in domestic growth markets. We will endeavor to continually enhance our corporate value and realize a sustainable society by working to resolve environmental, social, and economic issues through food.

Release

Summary

Financial Targets

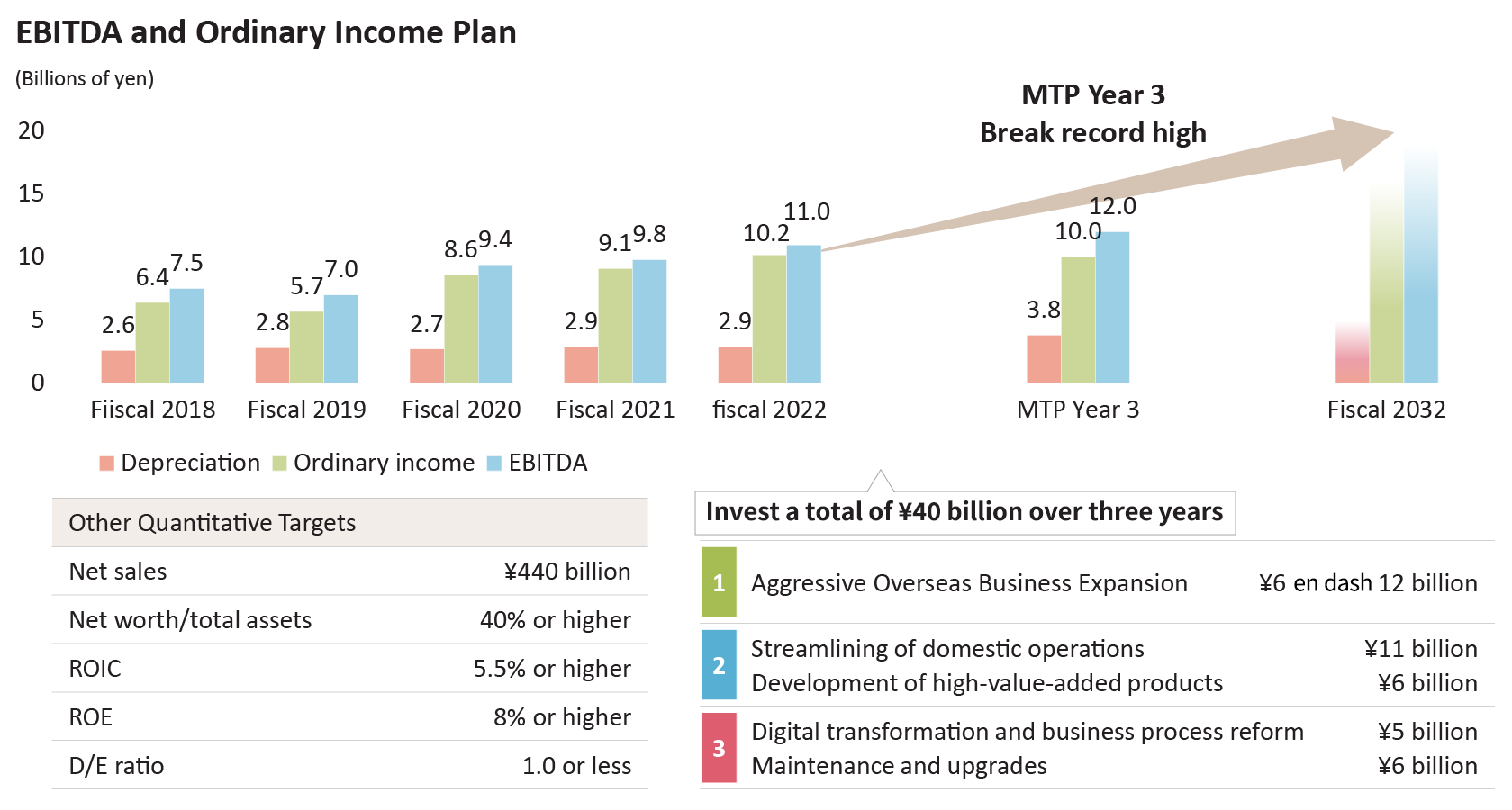

Depreciation from upfront investments will temporarily depress ordinary income

Plan to break record high for profits in its final fiscal year by increasing the portfolio weighting of the international business and high-value-added products

The framework of the plan also includes maintaining and increasing return on invested capital (ROIC)* (5.5% or higher), maintaining and increasing return on equity (ROE) (8.0% or higher), and maintaining net worth as a percentage of total assets (40% or higher).

(1) Investment Plan

Investment totaling approximately 40 billion yen over the three-year period of the new medium-term management plan (34 billion yen in new investment and 6 billion yen in maintenance and updates)

- Aggressive overseas expansion: Approx. 6 billion yen to 12 billion yen

- Streamlining domestic operations: Approx. 11 billion yen

- Development of high-value-added products: Approx. 6 billion yen

- DX and business process reform: Approx. 5 billion yen

- Maintenance and upgrades: Approx. 6 billion yen

(2) Stabilize the financial base: D/E ratio of 1.0 or less

ROIC = (Operating income after tax + Equity in earnings/losses of affiliates) / (Interest-bearing liabilities + Net assets)

Currently, the Starzen Group’s weighted average cost of capital (WACC) is around 4%.

Business and Other Risks

The major risks that the Group recognizes as having the potential to materially impact its financial position, operating results, and cash flows are described below. Note that this is not an exhaustive list of all risks. The Group may be impacted in the future by risks that are currently unforeseeable or deemed insignificant.

At the Starzen Group, we have established a system where the Risk Management Department discusses issues and measures related to group-wide risk management and promotion in accordance with the Risk Management Regulations and the Risk Management Division plays a central role in accurate management of various risks surrounding the business and a proper response to risks that materialize.

Forward-looking statements below are based on the Group’s judgment as of the end of the fiscal year under review.

1. Food Safety

The Starzen Group carries food products that are essential to people’s lives, and we recognize that we have a responsibility to society to ensure food safety. In order to fulfill this responsibility, the Group promotes various initiatives to ensure food safety. However, there is a risk that incidents falling outside of the scope of these initiatives may occur, such as quality problems that affect society as a whole. Furthermore, we take every precaution to manufacture our products in accordance with both food hygiene and health and safety standards. However, there is no guarantee that we can completely avoid the risk of product defects.

If such risks materialize, a large-scale product recall, product liability claims, loss of public trust, and other consequences could result in substantial costs and decreased sales volume. This, in turn, could have a significant negative impact on the Group’s financial position, operating results, and cash flows.

In response to such risks, the Group has established a system to provide safe and secure food products by acquiring Safe Quality Food (SQF) certification at 57 business locations to ensure the safety and quality of its food products. We have also established a Quality Assurance Division as a corporate organization. By assigning members of this division throughout the Group, we have established a system that allows us to manage the quality control and assurance of the Group in an integrated manner. The Group recognizes ensuring food safety and security as one of its most important issues to address, and will continue to further strengthen its quality control and assurance system.

2. Fluctuation in Meat Supply and Demand

The Group’s main product is meat. There is a risk of reduced procurement due to delayed growth of livestock due to abnormal weather or outbreaks of livestock diseases. There is also a risk of substantial fluctuations in meat prices due to changes in supply and demand both at home and abroad.

If such risks materialize, a decrease in the amount of meat procured, an increase in procurement prices, or a decrease in selling prices could result in a decrease in gross profit.

In response, we diversify the risk of reduced procurement volume due to livestock diseases and other factors by geographically dispersing affiliated farms, procuring from a large number of allied livestock producers in Japan, and importing from multiple countries. In addition, to mitigate the risk of fluctuations in meat prices, we procure meat based on forecasts of fluctuations in supply and demand, thoroughly manage inventories at appropriate levels, and work on strengthening the development and sale of meat products with higher added value.

3. Spread of COVID-19

In the event that COVID-19 and other viruses continue to occur and spread over an extended period, the potential risks to our business include increased consumer preference for low-priced products due to economic slowdown, reduced demand for food services, significant price fluctuations in imported goods due to shifts in the balance of supply and demand overseas, and increased uncertainty regarding the creditworthiness of business partners. In addition, if infection were confirmed among the Group’s employees, there is a risk that the supply of products could be disrupted due to a partial shutdown of operations.

If such risks were to materialize, there could be a decrease in operating income due to sluggish sales of relatively high-priced Wagyu beef and commercial products for the food service industry, increased costs for product procurements, defaults on accounts receivable, and missed sales opportunities arising from suspension of operations.

Despite these risks, we recognize that we have a responsibility to provide a stable supply of food essential to people’s daily lives, and we will fulfill this responsibility by implementing the measures below.

The Group has established the COVID-19 Response Headquarters to implement the measures below to prevent new infections.

- Thorough awareness-raising activities on washing hands and gargling Mask wearing at all times Daily temperature checks

- Recommendation of working from home (telecommuting) Development of web conferencing environment and promotion of its use

- BCP measures for when someone is infected

- Thorough management of receivables and fund administration

In addition, since COVID-19 began spreading, demand for food services has been sluggish, while demand for home cooking has been rising. To capture this demand for home cooking, we will focus on proposing products in line with this trend. Moreover, we will aggressively pursue sales of products for e-commerce sites, which have been expanding since people were first asked to voluntarily stay at home.

4. Public Regulations

- If there were to be restrictions on imports or transport due to outbreaks of livestock diseases, including African swine fever, classical swine fever, BSE (mad cow disease), foot-and-mouth disease, and avian influenza, it could have a significant impact on the supply-demand balance, leading to the risk of sharp fluctuations in market prices or the risk of restrictions on product procurement.

- In the event that safeguards or other regulations pertaining to tariffs are put into effect, there is a risk of sudden fluctuations in market prices and a risk of restrictions on product procurement.

- Our products are subject to quality labeling laws and regulations. If new regulations are established in the future, there is a risk that we will be required to take additional steps to address them.

If such risks materialize, they could cause operating income to decrease due to increased procurement costs, lost sales opportunities, and expenses incurred to address new regulations.

In response to such risks, the Group diversifies risk by procuring products from a large number of allied livestock producers in Japan and importing from multiple countries. In addition, the Group has established a Quality Assurance Division as a corporate organization. This division continually and rigorously checks quality control and quality labeling and has a system in place to respond swiftly and appropriately to new public regulations.

5. Natural Disasters and Climate Change

In the event of a natural disaster such as a major earthquake or fire, or an accompanying large-scale power outage, or an extreme weather event such as a large typhoon or heavy snowfall that causes extensive damage to production and storage facilities or to roads, ports, and other infrastructure used for shipping, there is a risk that it could take a long time to restore production and shipping. There is a risk that this may cause a disruption in the domestic supply-demand balance, resulting in significant fluctuations in the market price of meat. In addition, there is a risk that natural disasters may cause damage to employees, offices, and facilities, creating difficulty for the Group’s business operations.

If such risks materialize, the potential impacts include a decrease in sales due to delays in shipments, fluctuations in gross profit due to changes in market prices, or temporary losses due to deterioration in the quality of inventory in storage or damage to our facilities.

In response to such risks, the Group has a system in place that allows us to maintain a certain degree of mutual complementarity between meat product manufacturing, storage, and sales facilities located throughout Japan in the event that these risks materialize.

6. Overseas Expansion

The Starzen Group is engaged in business activities in North America, Europe, Oceania, Asia, and other areas outside of Japan. We will continue working to further expand our overseas business. However, in expanding these overseas business activities, there are risks of restrictions being imposed due to various factors, including the following:

- Differences in contract terms and other commercial practices

- Changes to laws or regulations

- Social disruptions caused by terrorism, war, epidemics, natural disasters, or other events

- Unforeseen levels of market and exchange rate fluctuations

- Unfavorable political and social factors

- Negative attitudes towards Japan or sentiment of local residents

- Leakage of intellectual property or technology

If such risks materialize, the Group’s business activities may be restricted in various ways, causing its financial position and operating results to deteriorate.

In response to such risks, the Group will strive to gather information on the country in question when setting up new operations overseas. We will organize this information using mega-trend analysis and other methods to proceed with decision-making while assessing the degree of risk. Furthermore, in the event of any social unrest, we will promptly conduct safety checks for expatriate employees and their families. At the same time, we will provide instructions and education to ensure their safety in accordance with the guidance of local authorities and the Japanese embassy.

7. Compliance

If compliance issues arise, including violations of laws and regulations by individual officers or employees, there is a risk of the Group losing public trust.

If such risks materialize, the Group’s business activities may be broadly restricted, bringing about a serious negative impact on its financial position, operating results, and cash flows.

In response to such risks, the Group has established a Compliance Committee and other compliance systems. At the same time, we are working to foster and improve compliance awareness through such measures as familiarizing all officers and employees of the Group’s common compliance rules, code of conduct, and corporate behavior guidelines.

8. Information Security

The Starzen Group handles a wide range of information in the course of its business activities. As such, there is a risk of information leakage, destruction, tampering, loss, or prolonged access restrictions arising from unforeseen levels of natural disasters, extended power outages, computer virus infection, unauthorized access, or other such incidents.

If such risks materialize, the leakage of confidential information or other such incident could result in a loss of public trust or business activities may be broadly restricted due to the loss of information integrity and availability, bringing about a serious negative impact on the Group’s financial position, operating results, and cash flows.

In response to such risks, the Group has implemented the following main measures:

- Establishment of the Information System & Security Rules to safely manage personal information (especially customer information) and confidential information, prevent leaks, and implement appropriate security measures

- Regular IT security training and educational campaigns for the Group’s officers and employees

- Establishment of a mechanism that prevents data from being stored on information devices by utilizing a virtual desktop infrastructure, thereby reducing the impact in the event of device loss or theft Establishment of a mechanism to isolate devices from the network in the event of infection with a computer virus to prevent the spread of infection

- Diversification of risk by installing servers for information systems in two locations in Japan and constantly synchronizing the data so that even if one server is damaged by a disaster, the other server can ensure business continuity

9. Environmental Protection

In the course of its business activities, the Group is at risk of creating environmental pollution as a result of accidents, negligence, or other incidents, which could give rise to liability for damages resulting from such pollution, or additional social demands for environmental protection.

If such risks materialize, the Group’s profits may decrease due to costs associated with environmental restoration, payment of damages, costs related to addressing additional social demands, or loss of public trust if the Group is unable to meet social demands.

In response to such risks, the Group observes environmental regulations and promotes initiatives such as the following to engage in environmentally friendly management for which there has been strong social demand in recent years:

- Initiatives to reduce food loss and waste with technologies extend best-before dates and with pig farming using eco-friendly feed

- Modal shift, consolidation of refrigerated and freezer storage, redevelopment of delivery routes of company-owned sales vehicles, and gradual switch to low-emission gas vehicles

- Establishment of Sustainability Committee, endorsement of TCFD, establishment of KPI for greenhouse gas reduction in climate change projects, formulation of measures, and promotion of energy conservation activities

10. Exchange Rates

The Group conducts certain import and export transactions of raw materials and products in foreign currencies. In addition, the financial statements of overseas affiliates are prepared in foreign currencies. As such, the Group is exposed to risks related to fluctuations in foreign exchange rates.

Fluctuations in foreign exchange rates impact the revenue and expenses related to the Group’s import and export transactions, as well as the yen-equivalent amounts of foreign currency-denominated trade payables and receivables. These fluctuations also affect the translation of amounts in the financial statements of overseas affiliates into yen, thereby impacting the Group’s financial position and operating results.

The Group enters into forward exchange contracts to mitigate the impact of foreign exchange rate fluctuations on export and import transactions. However, if exchange rate fluctuations occur beyond the anticipated range, the mitigation effect may not be fully realized.

11. Decline in Profitability of Capital Assets

There is a risk that the Group may not be able to recover the initial amount invested in its capital due to a decline in profitability caused by changes in the business environment that were not anticipated at the time of investment. This includes higher procurement costs due to global supply and demand fluctuations, higher manufacturing costs due to labor shortages, and intensified competition due to shrinking of the domestic market.

If such risk materializes, the book value of the capital assets will be reduced to the recoverable amount, and an impairment loss will be recorded.

The Group seeks to minimize this risk by gathering members from relevant departments to hold an Investment and Financing Review Meeting when making significant investments. During these meetings, the appropriateness of investment plans, including the underlying assumptions, is thoroughly examined. In addition, after the investment is made, we continuously monitor the investment performance and analyze discrepancies between planned and actual results. This allows us to implement appropriate improvement measures.

Disclosure Policy

1. Basic Policy

The Starzen Group (the Company) strives for transparent, fair, prompt, and appropriate information disclosure to build long-term relationships of trust with all stakeholders, including our shareholders and investors.

2. Criteria for Information Disclosure

The Company discloses information on various decisions, events, and financial results in an appropriate manner in accordance with the Financial Instruments and Exchange Act and other relevant laws and regulations, as well as the Timely Disclosure Rules established by the Tokyo Stock Exchange.

At our discretion, we also strive to actively disclose information that is not subject to the Timely Disclosure Rules if it is deemed useful for promoting understanding of the Company.

3. Method of Information Disclosure

Information subject to the Timely Disclosure Rules is disclosed on the Timely Disclosure Information System (TD-net) provided by the Tokyo Stock Exchange after prior explanation to the Tokyo Stock Exchange in accordance with the rules. We also publish the information on the Company’s website without delay.

Annual securities reports and quarterly reports are disclosed on the Financial Services Agency’s Electronic Disclosure for Investors’ NETwork (EDINET) system, as well as promptly published on the Company’s website.

Note that information published on the Company’s website may contain different expressions than what is used in the information disclosed via other means. Thank you for your understanding.

4. Fair Information Disclosure and Prevention of Insider Trading

We have established the Starzen Group Rules on the Prevention of Insider Trading to properly manage important corporate information, prevent insider trading, and disclose information in a fair manner. At the same time, we promote thorough awareness and understanding of information management among all Group officers and employees.

5. Financial Forecasts and Forward-Looking Statements

Other than facts from the past to the present contained therein, the plans and forecasts disclosed by the Company are based on judgments and certain assumptions made from information available as of the time of disclosure. The Company does not guarantee the results. Actual results may differ from the plans and forecasts due to various risks, uncertainties, and economic conditions.

6. Quiet Period

To prevent information leakage and ensure fairness, the Company establishes a quiet period from the day after the last day of each fiscal period until the announcement of financial results. During this period, we refrain from commenting on financial results and performance and answering questions.

However, even during the quiet period, if the actual results are expected to significantly deviate from the financial forecast, appropriate information will be disclosed in accordance with the Timely Disclosure Rules.